In the recent corrigendum to the last order, FSSAI has updated the lab test fee. The partial changes have been added under Table 2: Testing Charges for Fruit & Vegetable products and Cereals & Cereal products of the earlier order issued by the authority on 3rd November 2021, FSSAI.

The corrigendum order was issued on 19th January 2023 and updated on the FSSAI website on 8th February 2023.

Read below in detail about the changes for the food type and new rates.

When is the testing fee applicable?

The Food Safety and Standards Authority of India (FSSAI) has prescribed the testing fees which will be uniformly applicable for both domestic and import samples drawn by Food Safety officers, authorized officers etc.

This fee structure is applicable from 1st December 2021.

Where to get the food samples tested?

Food samples can get tested at laboratories notified by FSSAI under section 43 of the Food Safety and Standards Act, 2006.

Is GST applicable on testing rates?

GST on these rates shall be applicable according to the Central Government while considering the amendments from time to time.

Different tables for the food type and testing rate reference.

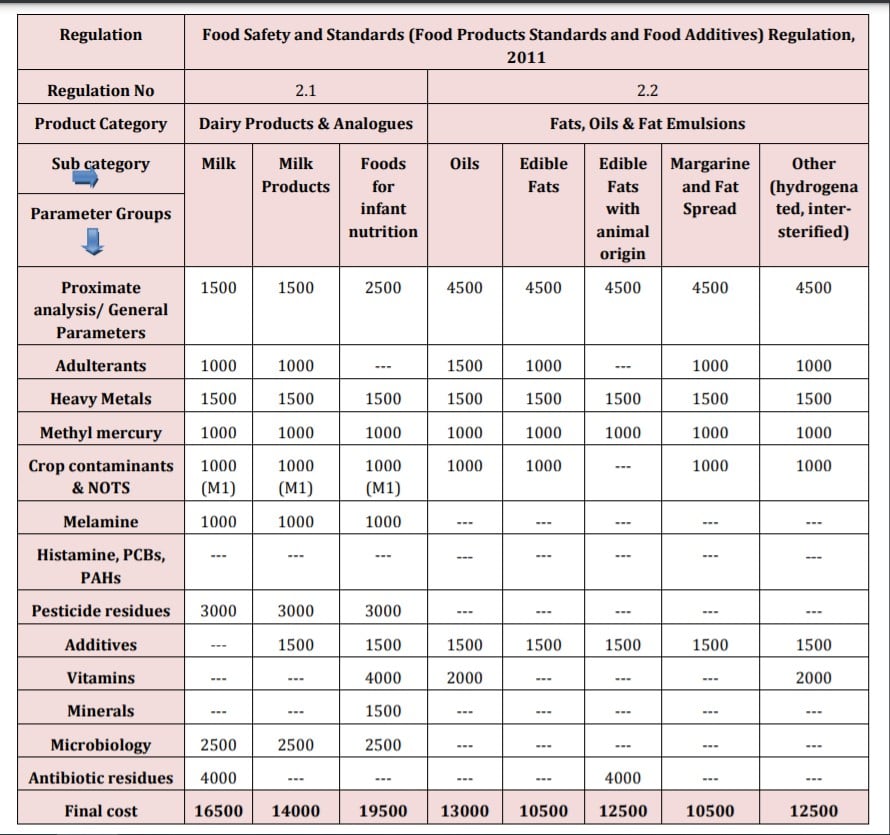

Table 1: Testing Fee for Dairy Products & Analogues and Fats, Oils & Fat Emulsions

Note:

- In the case of fortified milk, an additional Rs. 2000 may be charged for Vit. A and Vit. D together.

- In the case of infant foods(milk cereal-based complementary food, processed cereal-based complementary food), Total Aflatoxin and Aflatoxin B1 are also to be considered. So, an additional Rs. 1000 may be added.

- In the case of fats, oils and fat emulsions, Rs. 4500 for general parameters also includes fatty acid profiling and hexane residue

- In the case of oils(Cotton seed oil, Groundnut oil, Mustard oil, Coconut, Soyabean oil), the testing fee of Rs. 3000 for pesticide residues can be added, wherever applicable as per FSSR

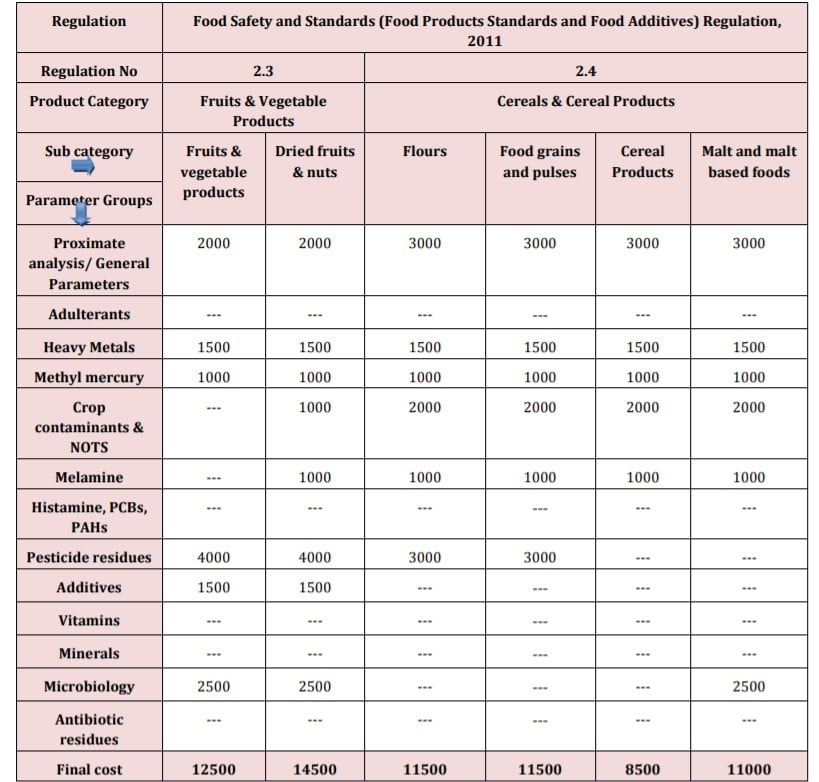

Table 2: Testing Fee for Fruit &Vegetable products and Cereal & Cereal products

Note:

- In case of Apple juice or apple juice used as an ingredient in other beverages, an additional Rs.1000 may be added for Patulin

- In the case of stone fruit juices or canned stone fruit, an additional Rs.500 may be added for analysis of Hydrocyanic acid

- In the case of Food containing mushrooms, an additional Rs.500 may be added for analysis of Agaric acid

- In the case of fortified atta and maida, an additional Rs. 2000 may be added when fortified with iron, folic acid and Vit.B12. In addition, Rs. 2000 may be added if also fortified with zinc, Vit A, Thiamine, Riboflavin, Niacin, and Pyridoxine, if declared on the label.

[Update: 4. In the case of Cereals and Cereal products including atta and maida and VitaminMineral Premix for preparation of fortified food, an additional Rs. 2000 may be added when fortified with iron, folic acid and Vit. B12. In addition, Rs. 2000 may be added if such products are also fortified with Zinc, Vit A, Thiamine, Riboflavin, Niacin and Pyridoxine if declared on the label.”]

5. In some flours (maida, Paushtik maida, Besan, Pearl barley, Whole meal barley powder, Soy flour, etc.), Food grains and pulses and cereal products additional Rs. 1500 for all additives (as mentioned on the label) can be added, wherever applicable

6. In the case of solvent-extracted flours (soy flour, sesame flour, coconut flour, groundnut flour &cotton seed flour, Rs. 1500 may be added for microbiological parameters (Total bacterial count, coliform count, Salmonella).

7. In the case of Formulated supplements for children, an additional Rs. 4000 for all vitamins, Rs. 1500 for all minerals and Rs. 1500 for all additives (as mentioned on the label) may be. The total testing fee of formulated supplement for children – Rs. 18000

[Update: 8. In the case of microbiological testing of food grain products, an additional Rs.500 may be added for each pathogen as applicable for that food grain product.]

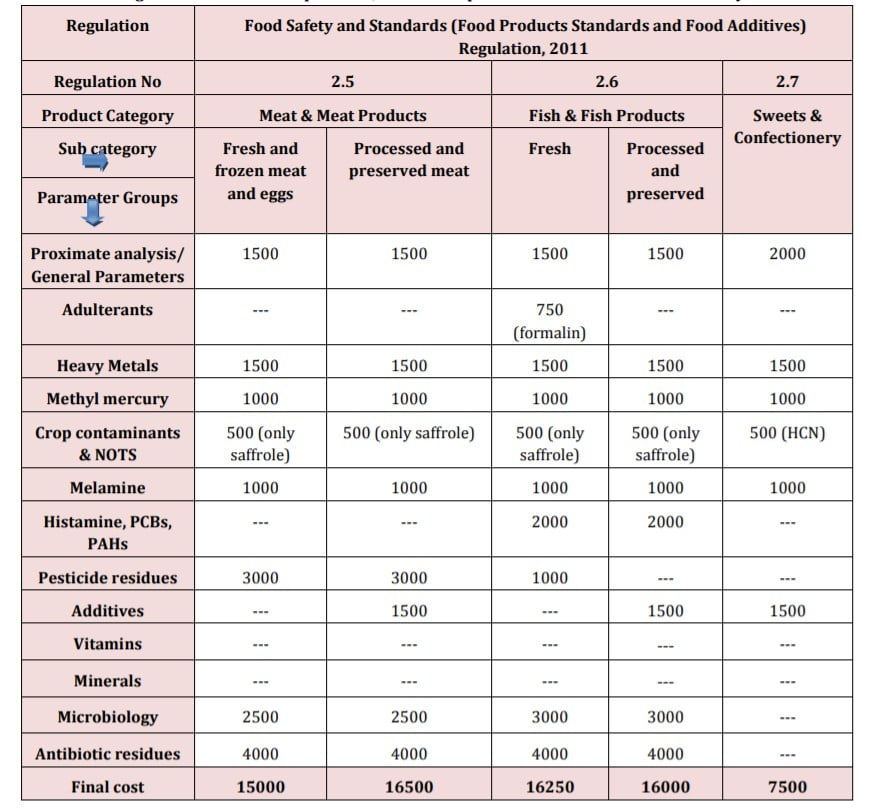

Table 3: Testing Fee for Meat & Meat products, Fish & Fish products and Sweet & Confectionary

Note:

1. In the case of Fish and fish products, an additional Rs.2000 may be charged for biotoxins, wherever applicable as per FSSR

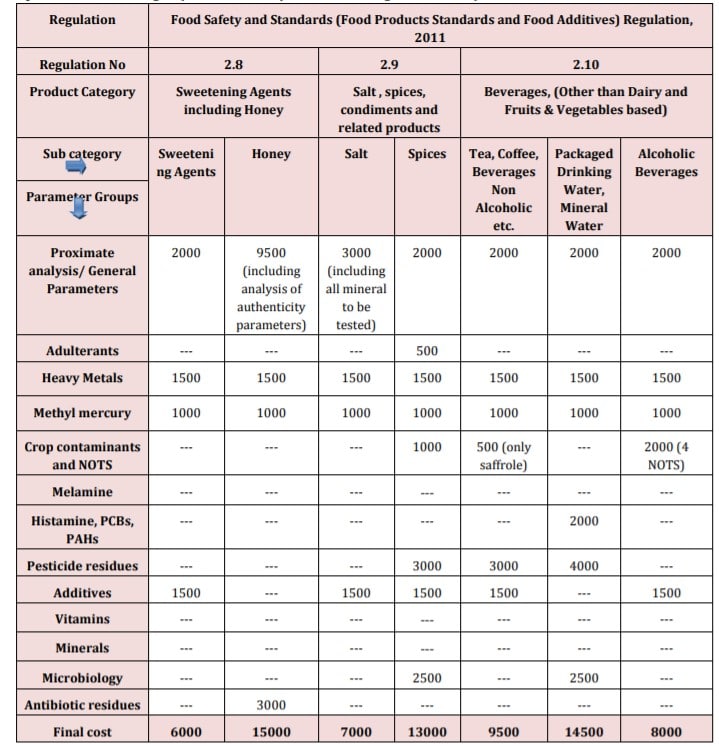

Table 4: Testing Fee for sweetening agents including honey, Salt, spices, condiments & related products and Beverages, (Other than Dairy and Fruits & Vegetables based)

Note:

1. In the case of Packaged drinking water, Mineral water etc., an additional Rs.5000 for radioactivity testing (Alpha activity & beta activity)

2. In the case of Carbonated water and non-carbonated water-based beverages, an additional Rs. 1000 for microbiological parameters (total plate count, coliform count and yeast & mould count)

3. In the case of Beer, microbiological parameters are to be tested; an additional Rs.2500 may be added to the testing fee for all microbiological parameter.

Also read: FSSAI Order On Upload of Lab Test Reports by Manufacturers, Relabellers and Repackers

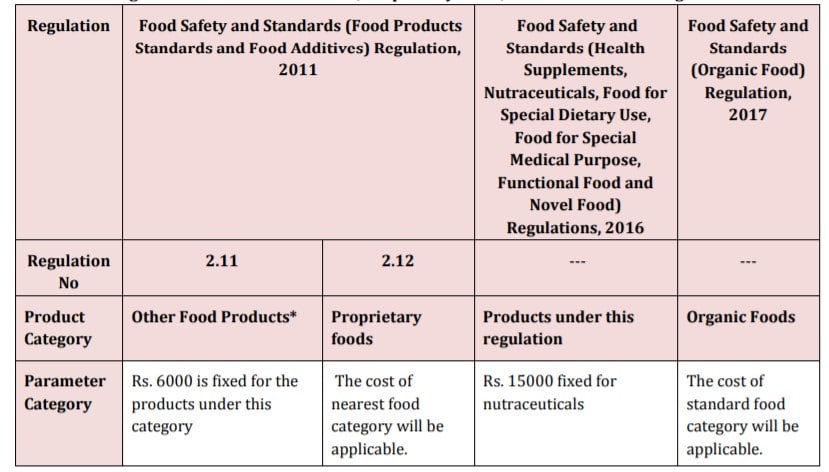

Table 5: Testing Fee for Other Food Products, Proprietary foods, Nutraceuticals and Organic foods

Note:

*The products included are Baking Powder, Catechu, Gelatin, Silver leaf, Pan Masala, carob powder, Dietary Fibre, and Special dietary food with low sodium content. Rs. 6000 includes general parameters, heavy metal, Methyl mercury, NOTS and Additives.

Conclusion

Hopefully, this blog helps Food Business Operators (FBOs) better understand the new revised new rates testing fee.

We would encourage FBOs to keep themselves updated about FSSAI development. If you feel like knowing more about different topics, please write in the comment box, and we will try our best to add to our learning series.